SBI Magnum Midcap Fund: 22X times growth since inception

Current market context

The volatility in the market in the past four months following the weaker than expected corporate earnings, coupled with INR depreciation and concerns about trade policies of the Trump Administration have led to heavy Foreign Institutional Investor (FII) sell-off. Nifty 50 has corrected by more than 12% from its 52-week high. Market has since recovered after President Trump announced a 90 day pause in retaliatory tariffs, with the Nifty trading above the 24,000 level despite the tense situation following the terrorist attack in Kashmir.

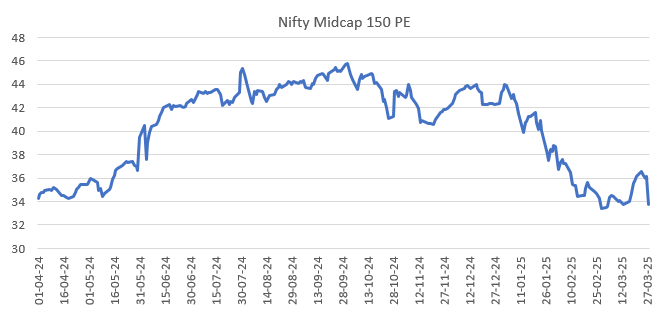

Valuations have eased

The deep correction in last quarter dragged midcap stocks into the bear market zone as the Nifty Midcap 150 TRI fell by more than 20% from its 52-week high. The sharp correction has brought valuation to reasonable levels (see the chart below) has eased valuations and bringing them to more reasonable levels. Current valuation scenario can provide attractive investment opportunities in midcaps for long term investors.

In this article, we will review the SBI Magnum Midcap Fund, which has maintained its track record as a strong performer since its inception in March 2005.

SBI Magnum Midcap Fund - regular growth option

The SBI Magnum Midcap Fund provides investors with opportunities for long-term capital appreciation along with the liquidity of an open-ended scheme by investing predominantly in a well-diversified basket of equity stocks of Midcap companies. Managed by fund manager Mr. Mr. Bhavin Vithlani, the fund has an AUM of Rs 20,890.26 Crores as on 31st March 2025.

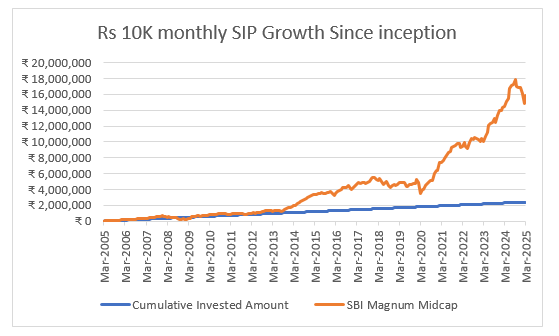

Wealth Creation with SBI Magnum Midcap Fund

A monthly SIP of Rs 10,000/- in the fund started at its inception would have grown to a corpus of Rs 1.58 Crores (as on 31st March 2025).

Source: Advisorkhoj Research as on 31st March 2025

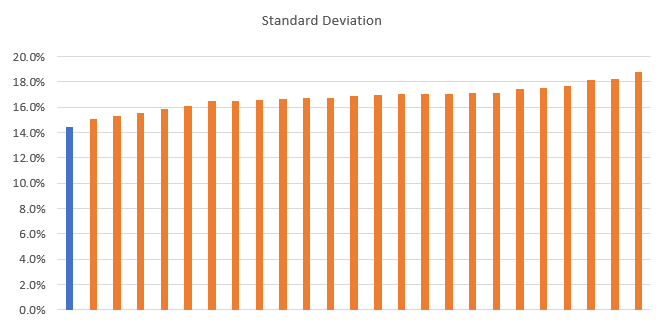

Lower volatility compared to peers

Standard deviation is a measure of a fund's volatility. We compared the standard deviations of all funds in the midcap category (which have completed at least 3 years). SBI Magnum Midcap Fund the lowest volatility compared to its peers.

Source: Advisorkhoj Research as on 31st March 2025

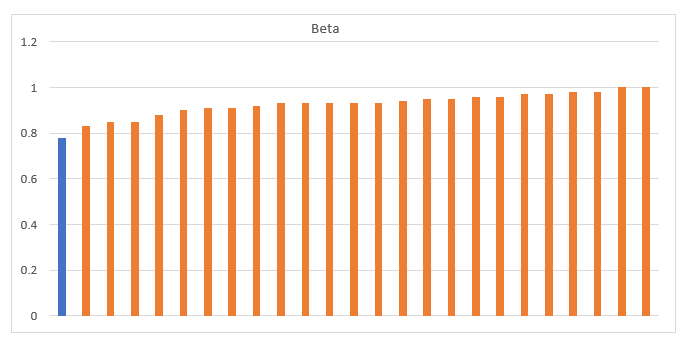

Lower systematic risks

Beta is a measure of systematic risks. We compared the betas of all funds in the midcap category (which have completed at least 3 years). SBI Magnum Midcap Fund the lowest beta compared to its peers.

Source: Advisorkhoj Research as on 31st March 2025

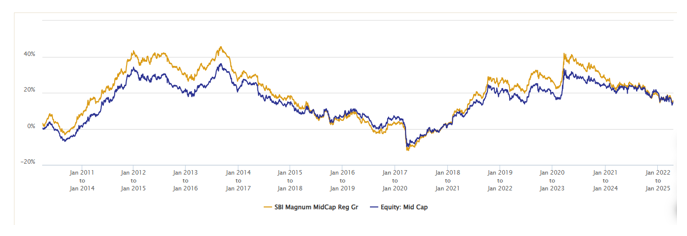

Fund Rolling Returns

The chart below shows the 3 Year rolling returns of the fund over the last 15 years. As you can see that the fund was able to outperform the benchmark. The average 3-year annualized rolling return of the scheme was 19.49% (versus 15.40% for the benchmark). The fund gave above 20% returns 53% times compared to the benchmark above 20% returns of 42% times over this period.

Source: Advisorkhoj Research as on 31st March 2025

Quartile ranking

The fund has featured in the top two quartiles in 6 out of the last 10 years. Overall, the fund has been able to give good returns in spite of the volatility characteristic of this market cap segment.

Source: Advisorkhoj Research as on 31st March 2025

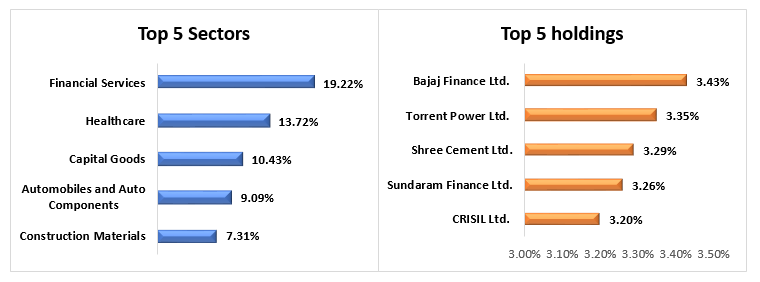

Portfolio Construction

As per SEBI's mandate the fund will invest at least 65% of its assets in midcap stocks. The fund manager uses a blend of growth and value investing and has a bias for sectors like finance, healthcare, capital goods, automobile etc. These sectors are expected to outperform as the economy is going through one of the most volatile periods since COVID 19. The fund is well diversified in terms of company concentration.

Source: Fund Factsheet as on 31st March 2025

Who Should invest in SBI Magnum Midcap Fund?

- Investors looking for capital appreciation over long investment tenures.

- Investors with high-risk appetites.

- Investors with minimum 5-year investment tenures.

- The best mode of investment in midcap funds is SIP over long investment horizons.

- However, investors can also take advantage of deep corrections to tactically invest in lump sum.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY